A lot of traders are afraid of volatility and the dropping markets, but personally these are my best P&L days with my scalping strategies because I have more entries, still a good win/rate, and the targets are hit so fast that I can repeat this in a short time and could call it a day after a few minutes.

I would like to take this opportunity to share the best setup I traded this morning.

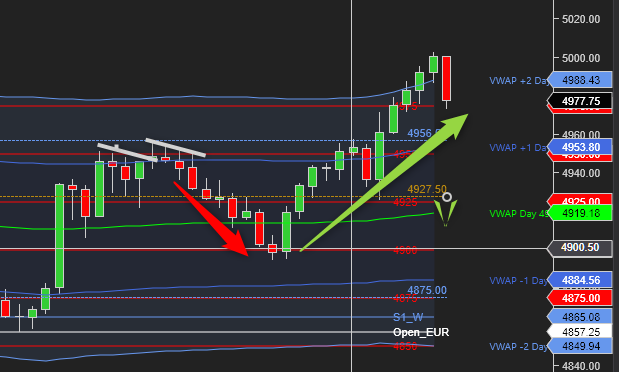

1. Lot of trendlines drawn by algos => market held by market makers

For years, I have been drawing your attention to trend lines because it’s typical algo activity that you want to master to start understanding what the next moves could be.

And this morning (talking about european session), there was trendlines made to induce buyers or sellers everywhere. I can’t draw it all but here are some:

On the right, we could even see 8 candle wicks (this is a 5min chart) perfectly aligned. If you followed my articles since a few years, you know these figures are there to induce sellers because this means lowest lows. But there is a high probability the price will come back above the highest wicks to take out the sellers stops.

2. Wait for the signals

Now that we have a big picture of today’s ES market, we need signals in lower timeframes to enter.

We guessed some sellers induction from the wicks, it does not mean we have to buy the market right now blindly. In fact, when you are scalping low timeframes, you have a potential short term sell signal there because showing aligned wicks may not be enough to induce sellers, it’s even better to show them the start of a down move going fast and they will jump in.

This is what TRFlowExpertSignals indicator is all about. This indicator is a cheat when you master how to read its signals.

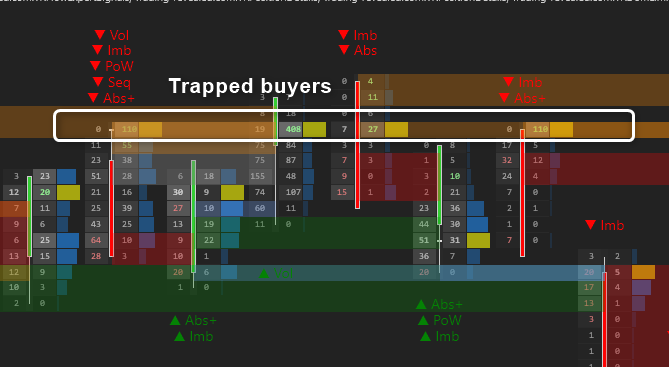

At the top of the 8 wicks we saw above, there was a very clear sell signal I would take every time. Multiple candle signals at the top (absorptions, imbalances, POC at the top with buyers trapped there, big volume, and order sequencing) + the level is retested with the same big signal, wow it’s a no brainer.

If I zoom in, with the numbers of orders, you can see the buyers volume trapped better:

3. Evaluate the move target

This part is much more advanced and you don’t need to master it now but… ok we have a sell signal and we guess that the entry zone could be revisited due to the candle wicks screaming to sell. So should we cut the trade very early or what?

My advice as a scalper is: cut most of your position when you can see some buyers taking the hand back on your entry chart and let a runner if you want. Then wait for others signals to re-enter a sell.

The relative trapped orders volume can tell you this: “well we can see an average of 50 orders at every price level traded, and now we can see 1000 buy orders trapped at a level” => this will give you a bigger move down than if you had 70 buy orders trapped at the same level because it would mean nothing for the current market.

In fact, a good and simple target for this is often VWAP level because it’s the average volume price where market makers will find some buyers/sellers.

4. How I found the opposite buy entry ? the VWAP trap

So now a good typical place to trap sellers and go the opposite way is a trap we often see in ES market: the VWAP trap.

If you look at the price behavior around VWAP every day, you should see the same stuff: VWAP is seen as a good average price, it means a lot of retail traders and funds strategies are to sell when the price cross below VWAP (or buy when the price cross above VWAP) because they don’t want to miss THE big move.

And this is where the “smart money” will trap orders. This morning they trapped between VWAP level and 4900 and then the price shoot back up to finish the sellers’ accounts.

In the footprint chart, I could see several buy signals. I had to cut some trades with small profits before the big one because of course even with good signals, the price could revisit lower before starting the big move. Nothing is 100% predictable in the market.

I really hope you learned something from this article. Feel free to join our Discord or comment the article to ask questions if something is not clear, there is no stupid question.

Leave a Reply