Date : 08.25.2021

Instrument : Dax CFD

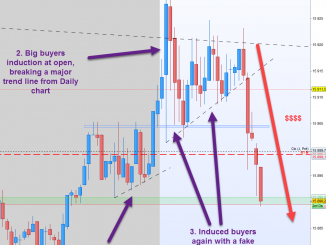

I want to show you another trap that just happened today (at the time I’m writing this article) on the Dax. This time it’s a buyer trap.

I will repeat some stuff there because there’s nothing really in this trap compared to the usual traps. It uses fake trend line, fake horizontal support/resistance retest and a bigger move to induce. That’s all.

Let’s explain a bit more what happened on the chart:

- A micro up trend line has been created before London open. Look at the wicks alignement, it’s not random.

- There was bigger up move at London open to induce more buyers. But the most important to notice here is what people don’t really see. This up move was a very high probability move because you have several interesting confluence to trap the buyers and take some sellers stops there (see the next paragraph for more details).

- They induced more buyers (retracement buyers) with a fake resistance zone becoming support + a new up trend line.

Then the real move down happened. Buyers are KO.

Why the up move at London open was a high probability move?

You have several liquidity zones grabbed with this move + several breakout from zones + a major trend line. More information on the chart below:

As usual, I hope you enjoy these explanations and you learn something from it.

Happy trading!

Leave a Reply