I will try make a result summary from DAX Midday-Trend Algorithm on a monthly basis to analyze the results. I will show you the losses and the profits from a real account where the Algorithm is running. I want to be transparent, and more than that I want to improve the algorithm over time, it involves results analysis as a first step.

1. September 2021 live results

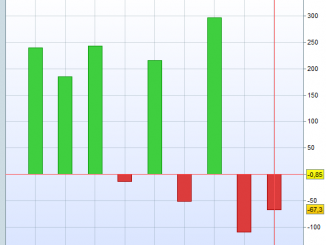

The trading algorithm lost 67 points in backtests versus 75 points on the live account this month.

I didn’t notice any difference between the backtest results and the results from the live account until this month. This is not a huge difference but I reviewed all september’s trade to check.

I found out that the difference comes from the position from september the 1st: at 4:00 PM Paris time, the spread had been increased on the live account, most likely during the ISM manufacturing news. This triggered the profit taking at 40 points (the algo sets a trailing stop at +40 points when a short position reaches 70 points) but not in the backtests where the position has been closed at 10:30 PM giving a few more points win. This can happen and unfortunately there’s nothing I can do in prorealtime to simulate these unusal spread openings in the backtests.

As I said last month, The Dax Midday-trend algo was designed to benefit from big trends, and this september the dax has been ranging between 15000 and 16000, therefore it was not a winning month. I’m doing some tests on some new improvements to see how we could get better results from these ranging periods.

2. Equity curve review

The bigger equity curve picture is still correct, we have shifted a bit below the moving average. It happened several times during the last years (like in june 2021, sept 2019 and dec 2018) and every time the algo started a new uptrend immediately after these drawdowns.

If I zoom on September, we can see that the DAX Midday-Trend Algo was in profit for the most part of the month and then give back the profit at the end of the month.

3. What about the change from DAX30 to DAX40?

I received some questions about the new DAX formula with 40 companies instead of 30. Do I think it change something on the algorithm behavior? Short answer: No.

The Dax structure is still the same and the biggest companies from the Dax are still the same. The importance of a few companies like SAP or Siemens in the Dax indice still remains and I don’t think we will a major behavorial change in the Dax moves. The first days from the Dax 40 are confirming this assumption. We will see what the future bring us.

I will monitor it and will make changes in the values set in the algo (stop, profit targets points) if I see a major change in the market structure and volatility coming from the new Dax40, but as I said I don’t expect it to happen.

Conclusion

We have to remember that the DAX Midday-Trend system is not a scalping system, it’s day trading system and it doesn’t open trades every day. We will have loosing months but looking at 1 months results is not enough for such a system, we have to be patient and let it run to benefit from the trending days.

Looking at similar previous drawdown periods from the Algo, we can see that sometimes the algo can be pretty much flat during 6 months before going back in profits. And as such this algo is not suitable for short term investors.

Poster un Commentaire