Dax sell analysis from April the 1st 2022

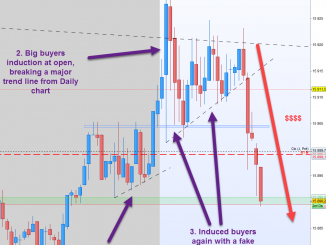

Date : 04.01.2022Instrument : Dax CFD I took a SELL intraday trade last friday using one of my favorite setup. Nothing new as I already […]

Date : 04.01.2022Instrument : Dax CFD I took a SELL intraday trade last friday using one of my favorite setup. Nothing new as I already […]

I reported the DAX Midday-Trend algo results every month from august to october for the commercial launch. Now I would like to report it every […]

Date : 11.04.2021Instrument : Dax CFD I will come back on an interesting DAX sellers trap setup from october the 29th that actually combines a […]

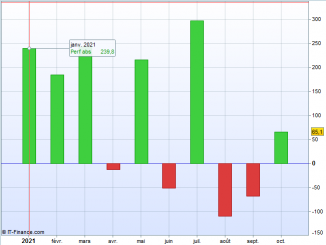

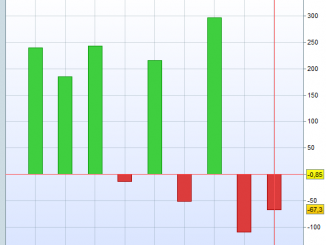

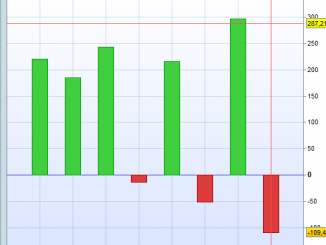

Let’s have a look at last month results (october 2021) for the algorithm as I did for the previous months. This month is a bit […]

I will try make a result summary from DAX Midday-Trend Algorithm on a monthly basis to analyze the results. I will show you the losses […]

I will try make a result summary from DAX Midday-Trend Algorithm on a monthly basis to analyze the results. I will show you the losses […]

Date : 08.25.2021Instrument : Dax CFD I want to show you another trap that just happened today (at the time I’m writing this article) on […]

These days on the Dax, I can see sellers traps pattern every single day. I will show you some of these patterns that you can […]

Copyright © 2025 trading-revealed.com