As mentionned in the previous report from 2021 results, I am now reporting the DAX Midday-Trend Algo on a quarterly basis. Here we go, let’s look at the algorithm results from january to march 2022.

1. January to March 2022 results: +289 points per contract

One more time, the results are net positive and that’s a good news. And moreover, all the 3 months are green!

We could be a bit disappointed with the small january and march results, but that’s still a 289 points per contract quarter with a really small drawdown as usual (14% using 2500 euros account).

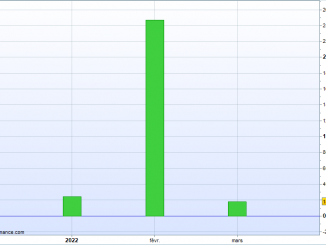

The results per month:

- January 2002 : +24 points per contract

- February 2022 : +247 points per contract

- March 2002 : +18 points per contract

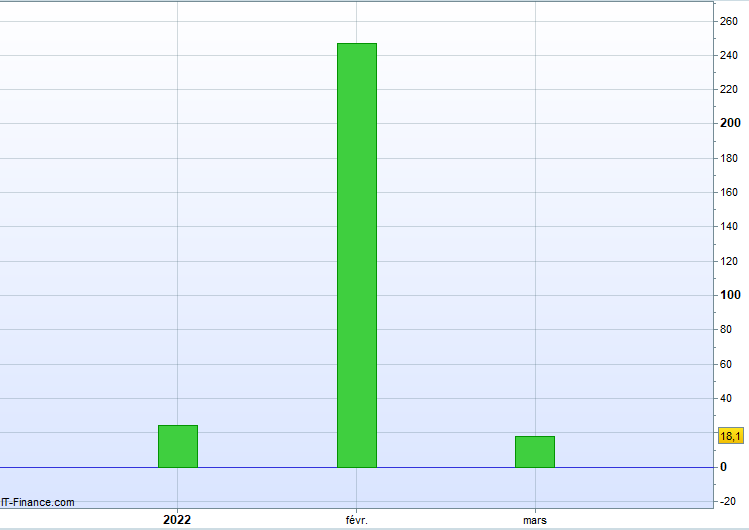

The equity curve for this quarter looks like this using a 2500 starting capital (for instance, it’s not a requirement/advice):

2. The importance of candy days

I guess you noticed something happened on March the 9th. This was one of the rare “candy day” (My expression for a big winning day). The algorithm managed to exit a trade with 423 points per contract profits, that’s huge!

It means this quarter results could have been much better than the actual results if we did not loose a lot of trades after March the 9th, but that’s not the most important here. I want to show you an important psychological stuff in trading, yes even with an automatic trading algorithm there’s still a human watching the trades, and we are human. We are always tempted to cut to a big winning position because we want to get this money in our account. And this money is not real until the position is closed.

What would have happened if we got excited and closed the position manually at +100 points because we considered it’s a big nice profit?

Well the simple and hard truth is: March results would be -305 points per contract instead of +18 points per contract. And this, would have given us a negative quarter too.

Do you see now why trusting the algorithm is so important?

Again it is designed to cut the losses as fast as possible, and to benefit from the large winning trades, and the historical backtests and live results speak for themselves. If you move the stop loss orders manually or cut the winning positions earlier (and I know how much it’s tempting), you can’t expect to have the same good results as in the backtests.

Conclusion

Even if I am personally a bit frustrated by the March results that could have been much better, that’s trading, we will have losses. And we still had a very good quarter there.

Also the algorithm is still pushing and made higher highs in the equity curve this quarter, that’s a good news. We can see that changing from a DAX 30 indice to DAX 40 didn’t have any impact on the algorithm, it’s still working the same way.

Leave a Reply