As usual, I will report the DAX Midday-Trend automatic trading algorithm results from the previous quarter (Q2 2022).

If you missed Q1 2022 results, you can find it here.

1. April to June 2022 results: +430 points per contract

One more time, the results are net positive and that’s a good news. Although April has been a bad month (we will take a deeper look at it in this article), the algorithm recovered without any issue.

The results per month:

- April 2002 : -454 points per contract

- May 2022 : +754 points per contract

- June 2002 : +130 points per contract

The equity curve for this quarter looks like this using a 2500 starting capital (for instance, it’s not a requirement/advice):

2. Notes about the April drawdown period

I noticed an unusal behavior in March and April caused by the high volatility around the mid day hours where the algorithm opens its position.

We had a couple of days in April where the position opened by the algorithm has been closed quickly in loss during the same or following candle. As the algorithm is allowed to open a position during 45 minutes (between 13h15 and 14h00 Paris Time), a second signal occured and another position was opened.

The issues are:

– while it could have been a good idea to take a second chance, the second position was quickly in loss too due to the high volatility

– it goes against the algorithm principle which is to open a position at mid day and keep it until the end of day as much as possible (it’s not a scalping algorithm).

I have worked on a fix to avoid having two trades opened the same day and tested it on historical data….

3. New algorithm version 2.2 => Q2 2022 +575 points per contract

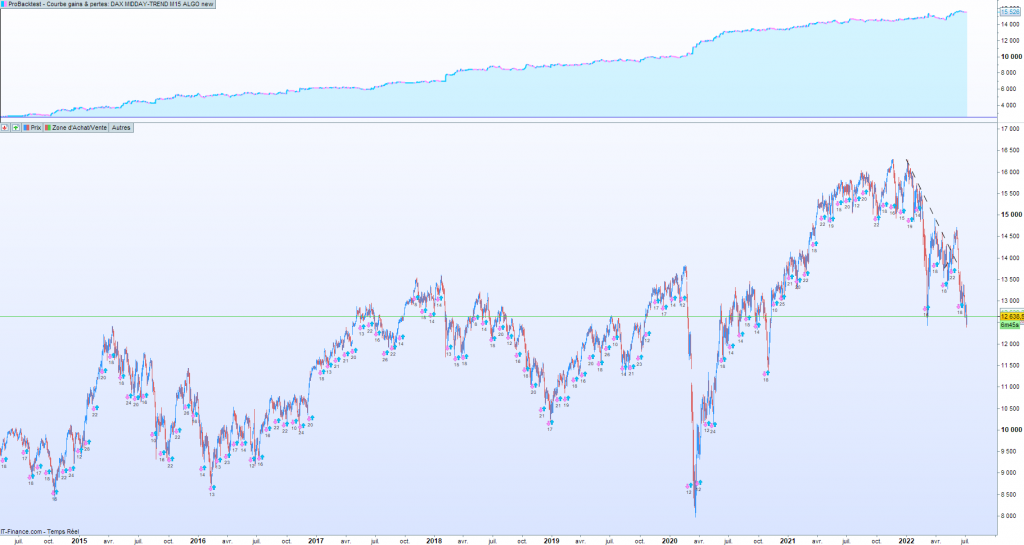

Let’s see the results for this new version. I have backtested it on 8 years data and I can confirm it didn’t change the past results but it fixed this new march / april behavior in the market.

The market is changing on a regular basis, I’m not surprised to see some new behavior from time to time.

Q2 2022 results with this new 2.2 version would have been : +575 points per contract (instead of +430 points for the current v2.1)

This is the equity curve difference on the DAX (1 euros per point) with a 2500€ starting capital:

(new version 2.2 on the top)

Conclusion

The algorithm results are still good, it continues to make higher highs in the equity curve. But I will still continue to work on improvements, especially on the recent drawdown we had in April because it’s the biggest one we had and there are always improvements that can be done. It’s true for every software but it’s mandatory for a trading algorithm to survive in the long run.

And this DAX mid-day trend algorithm has worked since 2014, let’s continue!

Poster un Commentaire